Solution Accelerator

Build a Modern Risk Management Solution in Financial Services

Adopt a more agile approach to risk management by unifying data and AI in the Lakehouse

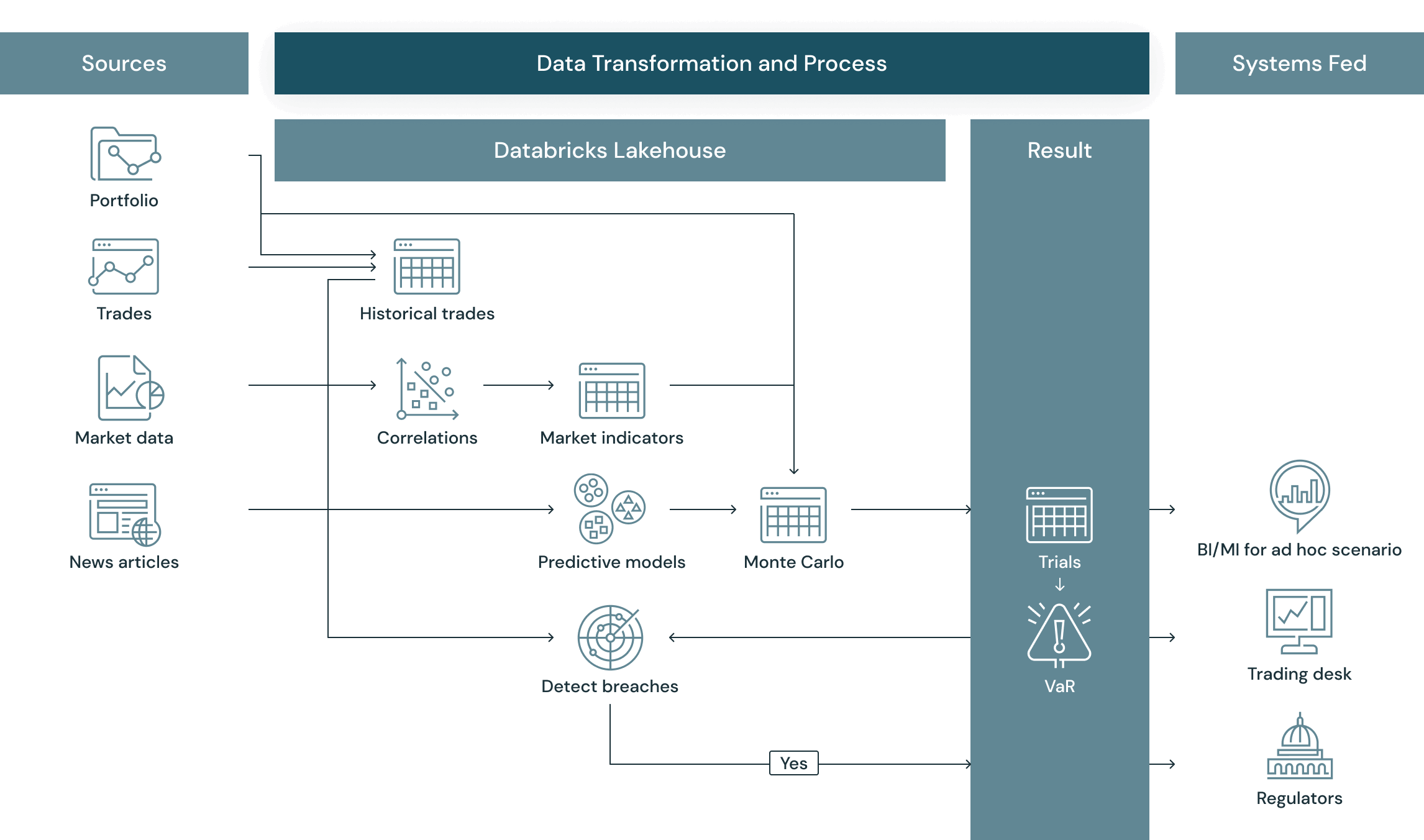

This solution has two parts. First, it shows how Delta Lake and MLflow can be used for value-at-risk calculations — showing how banks can modernize their risk management practices by back-testing, aggregating and scaling simulations by using a unified approach to data analytics with the Lakehouse. Secondly, the solution uses alternative data to move toward a more holistic, agile and forward-looking approach to risk management and investments.

Benefits and business value

Reference Architecture

Resources

Workshop

Blog

eBook