Supercharging Private Equity Portfolio Returns

Driving Operational Efficiency and Accelerating Growth through Data Intelligence

Executive Summary

In this blog post we explore how private equity (PE) firms can leverage data intelligence to enhance portfolio returns. We highlight the challenges PE firms face when acquiring new companies, such as data visibility, integration, and standardization issues. The Databricks Data Intelligence Platform is presented as a solution to these challenges, offering a unified and open cloud data platform, a data lakehouse architecture, AI and machine learning capabilities, and secure data sharing. By adopting Databricks, PE firms can streamline operations, reduce costs, gain deeper insights, and drive sustainable growth across their portfolio companies.

Introduction

Private equity firms are like elite personal trainers for businesses. They identify companies that need a major workout, design customized exercise and nutrition plans, and transform them into lean, high-performing powerhouses. By injecting capital, offering strategic coaching, and applying operational discipline, PE firms help these portfolio companies (PortCos) shed inefficiencies, bulk up on growth strategies, and ultimately reach peak financial fitness. This transformation process is critical to a healthy economy, as it fuels innovation, drives growth, and revitalizes underperforming businesses.

However, just as modern fitness training has evolved from basic workout routines to data-driven regimens, private equity must also step up its game in today’s fast-paced, data-driven world. To remain competitive, PE firms need more than traditional approaches. They must leverage the data they already hold, combined with advanced technology to streamline operations, optimize performance, and maximize returns. In this context, a robust data solution like Databricks Data Intelligence Platform serves as the state-of-the-art fitness facility equipped with advanced personal training tools, providing real-time insights, AI-driven recommendations, and seamless collaboration to help PE firms whip their portfolio companies into top shape.

Recently, we have been collaborating with our partner Collibri Digital on delivering several successful projects for private equity firms and their portfolio companies. Based on this experience, in this blog post we will show how the Databricks Data Intelligence Platform can act as a high-tech training facility to standardize data, boost productivity, improve insights, and drive sustainable growth across an entire portfolio.

Challenges with Acquiring Portfolio Companies and the Need for Open Standards, Interoperability and Standardization

When a private equity firm acquires a new company, it’s like a trainer taking on a new client who’s been doing inconsistent workouts, eating a haphazard diet, and logging fitness data on a piece of paper, or multiple, incompatible apps, or even, dare we say in an Excel spreadsheet. The first hurdle is getting a clear picture of the client’s current fitness level, habits, and goals, and for PE firms, that means dealing with data visibility, integration, and standardization challenges. Let’s explore some of these challenges in more detail:

- Poor Data Visibility, Inconsistent Financial Reporting and Integration Issues: A common issue is the lack of visibility into a portfolio company’s existing data. Many companies use disparate systems, ranging from outdated on-premise platforms to modern cloud-based solutions, creating fragmented and inconsistent data landscapes. This fragmentation makes it difficult for private equity firms to gain a holistic view of the company’s operations, finances, and customer behavior. Without integrated data, making informed, data-driven decisions becomes time-consuming and inefficient. Identifying key performance indicators (KPIs) across the portfolio and uncovering areas for improvement is hampered by siloed, unstructured, or incomplete data.

- Siloed Data Across Departments and Locations: Many portfolio companies operate in silos, with data spread across different departments, systems, or even geographic locations. This separation not only creates inefficiencies in terms of collaboration but also leads to inconsistent reporting and data duplication, further complicating efforts to streamline operations across the portfolio.

- Operational Incompatibilities: Every portfolio company has its own unique operational processes, often using different software and cloud infrastructures (such as AWS, Azure, or Google Cloud). Often data is locked into some proprietary format hindering interoperability, portability, and efficient data sharing. These differences create friction when attempting to establish a consistent data management approach across the portfolio.

So in order to unlock value across a diverse portfolio, private equity firms might want to standardize their data platforms and operations on a platform that is built on open standards, open protocols and highly interoperable. This approach brings several significant advantages. By consolidating data into a unified platform, firms can enforce consistent data governance policies and gain real-time visibility into all portfolio companies. Standardization also facilitates more efficient cross-portfolio analytics, allowing for easier comparison of performance metrics across different companies, which helps identify synergies and opportunities more quickly. Additionally, a consistent data platform minimizes redundant systems, streamlines reporting, and enhances operational efficiency across the entire portfolio.

That’s where Databricks Data Intelligence Platform, which is built on open standards and protocols, that is highly modular and extensible, offers a great solution to these challenges. Next, let’s discuss in detail how Databricks addresses these challenges.

Data intelligence reshapes industries

The Data Intelligence Platform for Private Equity

In the face of these challenges, the Data Intelligence Platform offers an ideal solution for private equity firms looking to streamline their data platforms and operations. Databricks is a unified data intelligence platform that allows PE firms to consolidate, manage, and analyze data across their portfolio companies cost effectively, delivering deeper insights and driving better business outcomes

Here’s how Databricks can help private equity firms overcome data challenges:

- Unified and Open Cloud Data Platform: Databricks integrates with all major cloud providers (AWS, Azure, Google Cloud), allowing private equity firms to standardize their data platforms regardless of the existing infrastructure used by each portfolio company. This eliminates the need to manage multiple cloud-native data platforms with a similar interface and products that simplifies the process of onboarding new companies to a centralized data system. Databricks platform is also built on open source and open standards ensuring interoperability and portability of all data and AI models.

- Lakehouse Architecture with Data Intelligence: Databricks’ data lakehouse architecture combines the best of data lakes and data warehouses, providing the flexibility to handle both structured and unstructured data in the form of documents like financial statements, companies house data or investment reports, while enabling fast and accurate analytics. This architecture ensures that all portfolio data is stored in one place, accessible to all key stakeholders. By centralizing data from disparate systems into a single platform, private equity firms can break down data silos, gain a holistic view of portfolio operations, and quickly generate actionable insights. Powered by DatabricksIQ, the platform's Data Intelligence Engine understands the unique semantics of your data. This engine optimizes performance, manages infrastructure, and simplifies the user experience through natural language assistance, making it easier for users to search, discover, and develop new data applications

- Gaining Meaningful Business Insights with AI and Machine Learning: Databricks comes equipped with advanced machine learning (ML) and artificial intelligence (AI) capabilities that help automate complex data workflows. For example, portfolio companies can use Databricks’ ML models to forecast demand, optimize pricing strategies, or detect anomalies in operational data. These automated insights help drive growth and reduce costs across the portfolio. Private equity firms benefit from the latest developments in GenAI with secure access to both frontier and open source Large Language Models (LLMs) like Llama 3.2, so they can build quality and accurate GenAI applications using their own data.

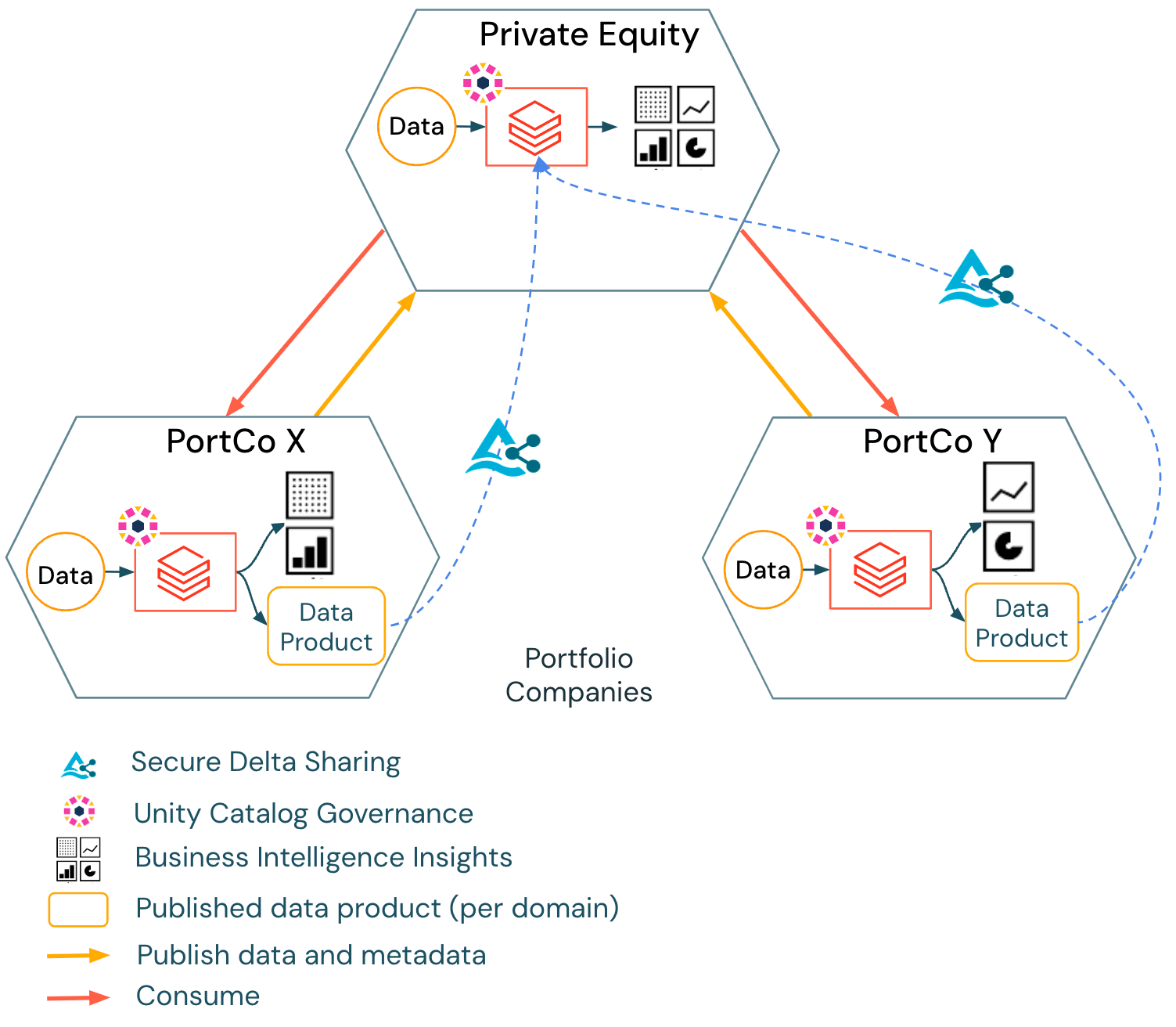

- Seamless and Secure Data Sharing with Delta Sharing: Databricks Delta Sharing and Marketplace enables secure, real-time data sharing between portfolio companies, private equity firms, and external stakeholders (such as consultants or strategic partners). This capability is critical for private equity firms looking to collaborate across their portfolio, share best practices, or involve external advisors in performance improvement initiatives. Delta Sharing provides a secure environment for sharing sensitive data, ensuring compliance with regulatory requirements (such as GDPR, HIPAA, SOC 2) and mitigating the risk of data breaches.

- Unified Data and AI Governance and Security: For private equity firms managing large volumes of sensitive financial and operational data, security is a top concern. Databricks offers robust security features, including encryption, access controls, and data lineage tracking, ensuring that data is protected and compliant with industry regulations. Databricks Unity Catalog, a built-in governance tool, also allows firms to enforce consistent data policies across their portfolio companies, ensuring that all data is properly managed and auditable.

In essence, as shown in the below architecture diagram, Private Equity with its Portfolio Companies can leverage Databricks Intelligence Platform to build quality data products and AI models, govern them at scale with Unity Catalog and securely share data assets with open Delta Sharing to provide real-time insights into business operations.

With this simple and streamlined design and approach, Private Equities can accelerate lowering cost of operations and improve productivity while also supercharge growth of the acquired Portfolio Company by gaining new insights into its operations and uncovering potential new opportunities.

Data Intelligence Lowers Costs and Improves Productivity

Beyond improving visibility and standardization, Databricks brings significant advantages in terms of cost savings and productivity gains for portfolio companies. By consolidating fragmented data platforms into a single, cloud-based environment, Databricks helps companies cut IT infrastructure costs. The automation of data management processes further reduces reliance on manual labor, lowering operational overhead. This centralized approach eliminates the need for separate analytics tools and platforms, reducing software licensing and maintenance fees.

Additionally, Databricks boosts productivity by enabling self-service analytics, giving business users in various departments—such as finance, HR, and operations—direct access to real-time data insights without depending on data engineers. This streamlines decision-making and allows faster responses to business challenges. Standardized dashboards and KPIs allow executives to easily compare performance across the portfolio, speeding up the identification of areas for improvement. With integrated tools like AI/BI Genie, which provides conversational experience for business teams to engage with their data through natural language, organizations are able to democratize data and gain new insights into their business.

Data Intelligence Accelerates Growth

Databricks empowers private equity firms to uncover new growth opportunities across their portfolios by leveraging advanced data insights. Through its powerful analytics tools, PE firms can analyze customer data to identify untapped market segments or discover potential for cross-selling and up-selling. The platform also enhances operational efficiency by providing real-time data to optimize supply chains, manage inventory, and streamline production processes.

With a clearer view of portfolio operations, Databricks enables private equity firms to develop data-driven growth strategies, leading to better-informed decisions regarding resource allocation, product development, and market expansion. This holistic approach ultimately helps firms capitalize on emerging opportunities and improve overall performance across their investments.

Conclusion

Private equity firms can unlock tremendous value by transforming data management into a high-performance workout routine. With Databricks Data Intelligence Platform as their equivalent of a modern and state-of-the-art training facility, PE firms can gain real-time insights, drive operational excellence, and maximize returns. By partnering with experts like Colibri Digital, who bring deep industry knowledge and implementation expertise, PE firms can accelerate their transformation journey and achieve superior results. Just as an athlete needs a coach to reach peak performance, a private equity company requires the right data strategy, a modern data platform, and an experienced partner to realize its full potential and expedite cost savings and growth opportunities findings.

Want to learn more about Databricks for FinServe? Explore The Data Intelligence Platform for Financial Services.

If you would like to learn more about our partner Colibri Digital, a digital engineering consultancy that helps customers navigate the rapidly changing and complex world of emerging technologies, with deep expertise in big data, data science, machine learning, and cloud computing, please visit their website. Colibri Digital creates well-structured, secure, scalable solutions at speed to provide the foundation for groundbreaking change, and they have experience working with private equity firms to help them maximize returns and operational efficiency by unlocking and harnessing the hidden potential of their data.

Never miss a Databricks post

What's next?

Data Science and ML

October 1, 2024/10 min read