Solution Accelerator

How to build: Alternative data analytics for investing

Leverage alternative data to nowcast portfolio companies and generate returns

Make better investment decisions from alternative data by uncovering valuable insights about trends, behaviors and risks. Alternative data extends across a variety of use cases, including back-testing, market risk and ESG investing to provide new ways of assessing value.

Benefits and business value

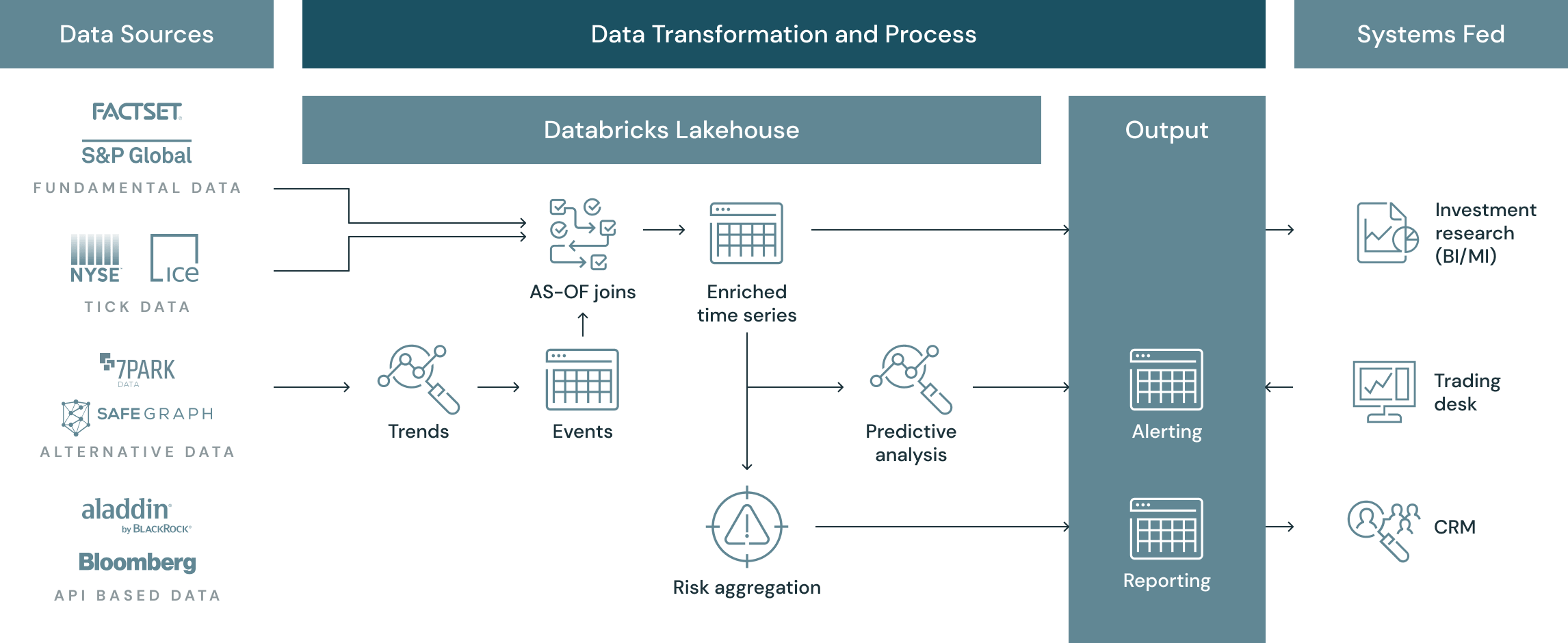

Reference Architecture

Resources

eBook

Case study

Webinar