Solution Accelerator

Credit Card Transactions Analytics

Pre-built code, sample data and step-by-step instructions ready to go in a Databricks notebook

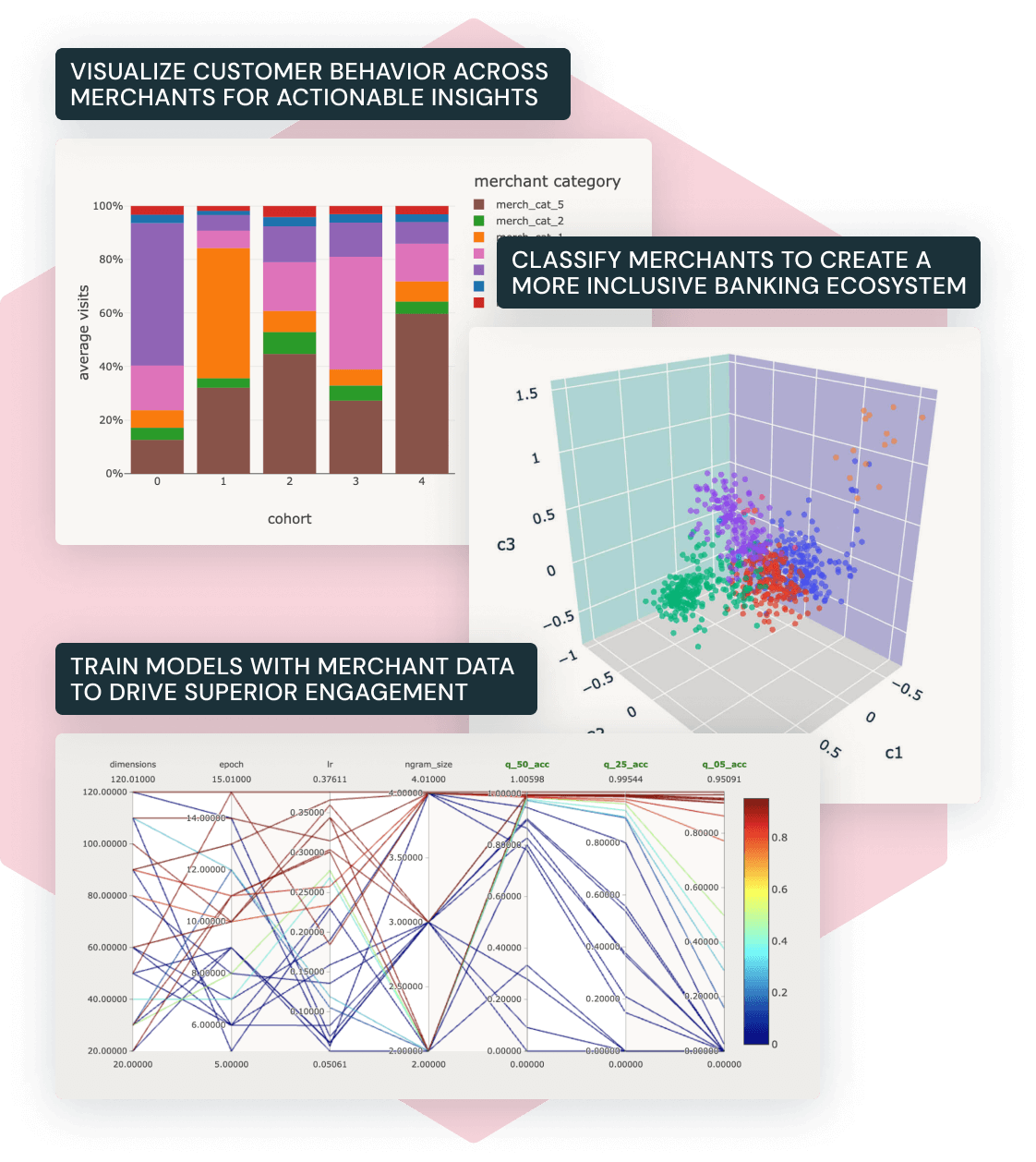

Merchant classification

Gain a 360-degree view into the customer to understand their spending behaviors, improve customer experiences and drive significant cross-sell opportunities.

-

Scale on the lakehouse to acquire, process, categorize and contextualize 1 billion card transaction data points

-

Extract customer insights from the contextual data passed from a merchant to a bank to boost card transaction authorization efficiency

-

Reduce manual effort and streamline operations with automation through machine learning

Hyper-personalized customer experiences

Uncover actionable insights into customer preferences, behaviors and patterns to deliver highly tailored experiences or to prevent fraudulent activity.

-

Classify card transaction data with clear brand information to unlock deeper customer insights

-

Leverage behavioral clustering to segment customers based on transactional patterns

-

Understand spending patterns using advanced techniques like graph analytics, matrix computation and natural language processing

-

Reduce the risk of financial losses for customers by identifying and flagging potentially fraudulent transactions

Regularity of payments

Improve the financial health and well-being of customers while reducing the risk of financial losses for banks.

-

Extract information about the regularity of payments from card transaction data to help customers be more responsible in their payment practices

-

Detect fraudulent activities that may impact the regularity of payments, such as identity theft or unauthorized transactions

-

Leverage machine learning to automatically send notifications to customers about upcoming payments

-

Estimate customer income to feed back into KYC processes

Resources

Video

Blog

Case Study

Deliver innovation faster with Solution Accelerators for popular data and AI use cases across industries. See our full library of solutions

Ready to get started?