How S&P Global Leverages ESG Data to Help Customers Make Sustainable Investments

Don’t miss our Global Sustainability Leadership Forum to hear how leaders from Goldman Sachs, Grab, Gro Intelligence and Microsoft are using data and AI to build a more sustainable, inclusive and greener future.

Environmental, social and governance (ESG) investing is a form of sustainable responsible investing (SRI) that considers both the financial returns and overall impact an investment has on the world. This is a growing focus for organizations looking to build more ethical portfolios to both drive social good and meet shifting consumer demands. These initiatives are also good for businesses, as ESG funds frequently outperform other funds. Unfortunately, wealth advisors, portfolio managers and asset allocators face three key challenges with sustainable investing:

-

- Lack of standardization around how companies disclose sustainability metrics

- Inability to effectively monitor ESG data

- Lack of automation in collecting the data due to its unstructured, unstandardized nature

Ultimately, taking a data and AI-driven approach to sustainable investing provides closures for all three of these gaps to ensure smarter, more informed investment decisions.

S&P Global (S&P for short) is an example of how organizations are driving growth while making ESG or sustainability initiatives core to their business. S&P Global enables financial services professionals to take a much more data-driven approach by providing companies with practical, useful data and expert analysis. In this on-demand webinar, Junta Nakai, Industry Leader for Financial Services and Sustainability at Databricks and Mark Avallone, Vice President of Architecture at S&P Global Market Intelligence, discuss real-world examples of the value of ESG data and third-party datasets to guide the investment process and make decisions that generate sustainable alpha.

The promise of a data-driven tomorrow

Just like every other area of business, financial intermediation is under a lot of pressure (fee compression, margin compression, asset investments, etc.) to perform. When you take a much more data-driven approach to ESG factors, professionals can more easily reassess and benchmark their business, redefine future plans and reinvent themselves if needed -- ultimately, relieving much of the related stress.

The promise of data can often sound too good to be true, but S&P has proven otherwise with its ability to leverage ESG data and artificial intelligence to help its customers make smarter socially responsible investments. Through their Global Marketplace, companies can access alternative and third-party ESG data such as social media and other non-financial data sources, and extract intermediary insights to make more sustainable decisions.

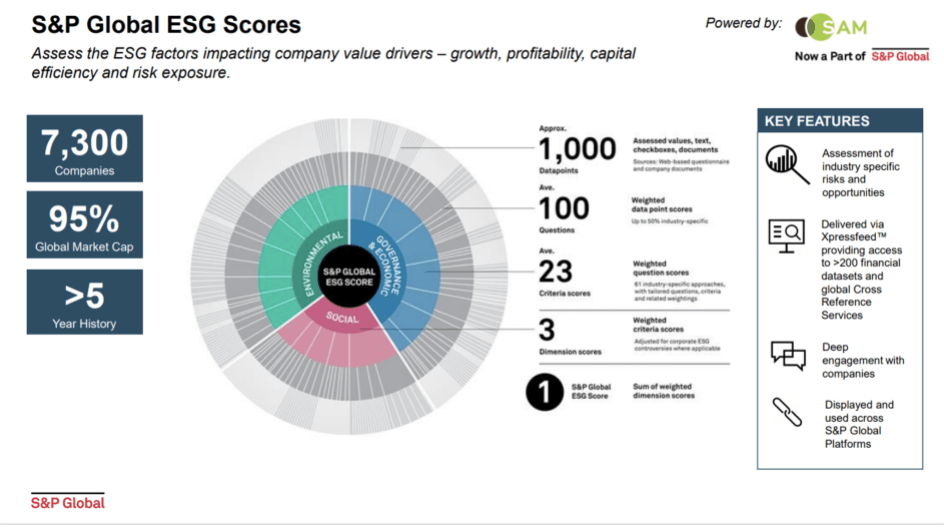

“Our ESG scores offer a really quick and dirty way to get working with ESG data,” explained Mark Avallone, Vice President of Architecture at S&P Global. “Through the use of Databricks, we’re able to use AI to parse unstructured data and to evaluate numerous factors and how companies are operating against them. The result is a score that’s reliable and standardized because it’s based on data that’s been collected over a long period of time. It’s incredibly important to have that history; you can’t just take a snapshot and base business decisions on it.”

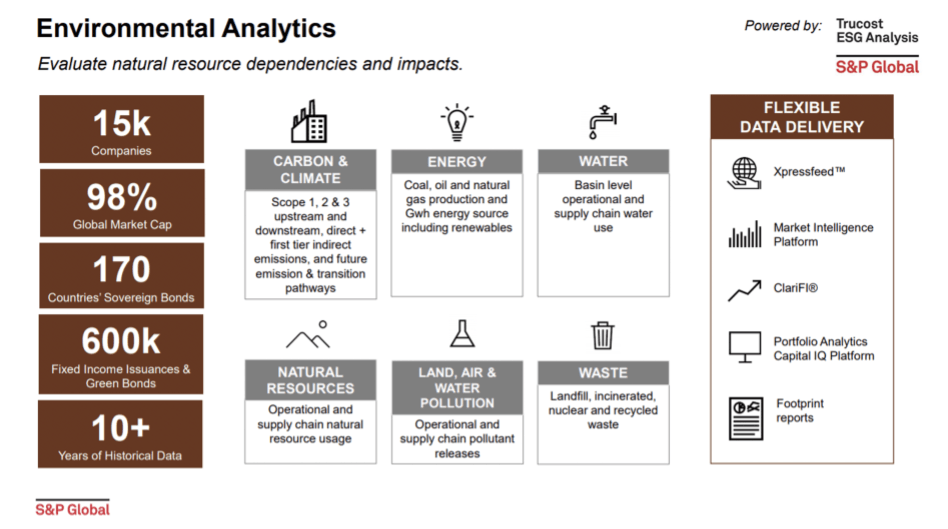

Thanks to Databricks, S&P is also able to drill down and offer insights on more granular unstructured data, such as environmental and weather data, as well as a marketplace for customers to explore different offerings. Enabled by a Lakehouse architecture on Databricks, S&P can easily federate their data and build reliable and performant data pipelines for all forms of downstream analytics, from business intelligence dashboards for customers and powering machine learning models to deliver ESG score predictions.

For example, they have the ability to model the impact of weather on airlines. “It’s a massive data set with over 9 million flights every year in the US alone,” said Mark. “Combined with weather data, we can determine trends over decades of time.”

Linking important information for better business decision-making (like airline and weather data) is what S&P is able to do for their customers on a regular basis. “We provide standardized data and wherever possible, the hooks in the data that link it to other data sets,” said Mark. “For years we’ve managed regulated financial attributes for millions of companies, and providing the ability to cross-reference environmental data with asset data is extremely powerful.”

Databricks 101: A Practical Primer

Delivering self-service ESG Analytics through Databricks

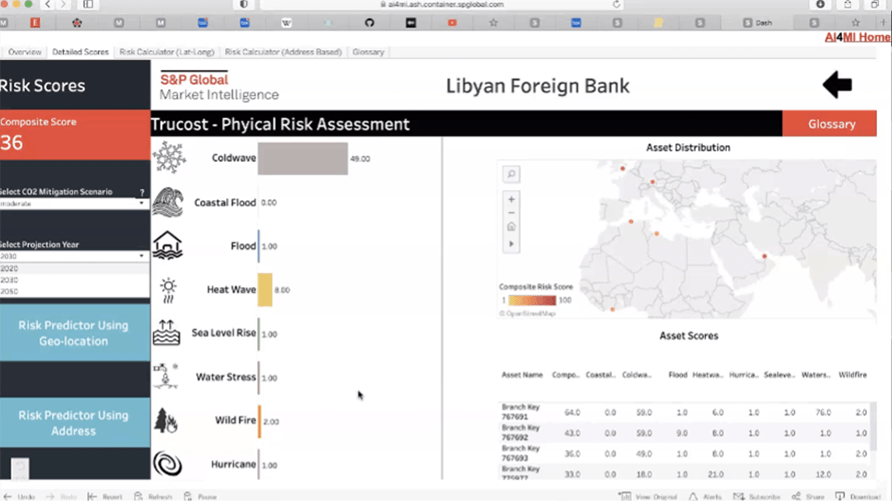

It’s so powerful, in fact, that S&P is productizing it. The company offers an API that can model physical risk over the next 10-50 years across a number of climate-related factors and then cross-references that to the geolocation of various assets. This enables customers to pick assumptions based on climate change and get a quick readout of exactly what the risks are across a number of related dimensions. And all of this is made possible thanks to the Databricks Lakehouse Platform, an open, simple platform to store and manage all of your data for all of your analytics workloads.

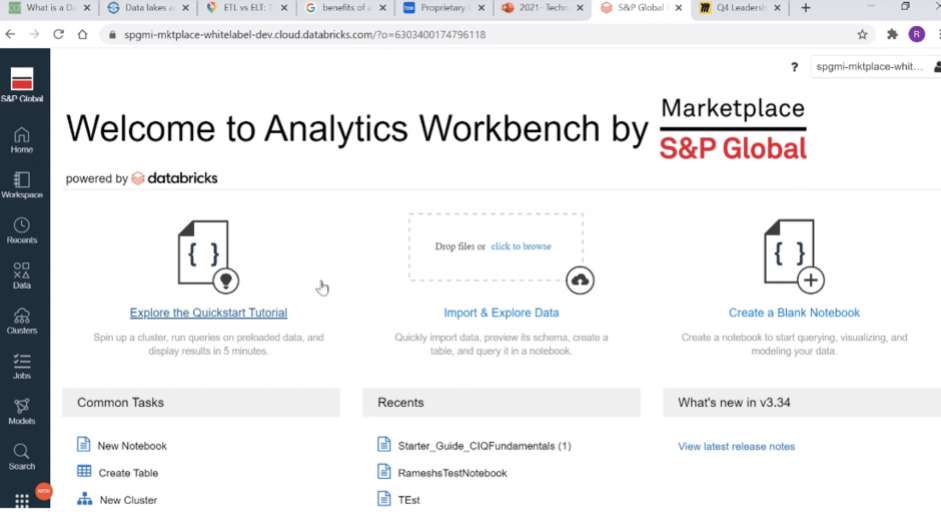

Through the Databricks notebooks environment, S&P has developed a customer-facing Analytics Workbench, which allows customers to easily access and unify available alternative and ESG data with the customer’s proprietary data to explore and gain deeper insights. All of these capabilities combined to enable them to make smarter and more sustainable investments.

Start taking a data-driven approach to sustainable investing

Ready to get started on your ESG journey? Check out these resources:

- Watch the full webinar replay to hear more about S&P Global’s ESG story

- Join our upcoming Sustainability Leadership Forum to hear from ESG leaders at Goldman Sachs, Gro Intelligence, Microsoft and Grab

- Download our new solution accelerator for ESG investing

- Learn more about our Financial Services data analytics and AI solutions

Never miss a Databricks post

What's next?

Technology

December 9, 2024/6 min read

Scale Faster with Data + AI: Insights from the Databricks Unicorns Index

News

December 11, 2024/4 min read