Coastal Community Bank Builds a Thriving Financial Ecosystem on Databricks Data Intelligence Platform

Special thanks to Barb MacLean, SVP, Head of Technology Operations and Implementation at Coastal Community Bank (Coastal) and Rob Cavallo, President at Cavallo Technologies for their valuable insights and contributions to this blog.

Prospering as a community bank among Goliaths

In some ways, it has never been tougher to be a community bank. The top 15 banks in the U.S. now control most of the industry's deposits and assets, with the biggest five banks managing 56% of total assets. Additionally, regulatory demands are increasing for smaller banks, requiring them to follow the same stringent capital, reporting, and anti-money laundering standards as their larger competitors. For Barb MacLean, SVP, Head of Technology Operations and Implementation at Coastal Community Bank (Coastal), the solution is Banking-as-a-Service (BaaS). To read more about how Coastal is using Delta Sharing to tackle a complex data environment, read the case study. At the core, Coastal's vision is to provide BaaS to trusted financial providers, with the goal of uniting partners to exchange customer data, offering tailored financial products, streamlined reporting and compliance, and enhanced fraud detection.

One such partner is One — an emerging fintech startup. Through its data sharing architecture built on the Databricks Data Intelligence Platform, Coastal has fostered a collaborative partnership with One through the sharing of account and other customer data to ensure a seamless banking experience that its customers can trust.

One is available to Walmart's 1.6 million associates and 150M+ weekly shoppers in addition to being available to consumers everywhere. Given the reach of One, the scale of data for even transactional elements they look to share with Coastal on a daily basis soon hits a limit in terms of how to move that amount of information easily, safely and securely while meeting financial processing time windows.

Real-time data sharing and collaboration hampered by complex legacy systems

Coastal's CCBX division has formed a partnership with fintech startups like One, where it supplies banking services for One's online banking offerings. This required integrating different data systems to ensure seamless customer transitions and up-to-date interactions, all while maintaining strict data security and privacy standards.

"We deal with an environment full of legacy technologies and dynamic partner environments, with third-party involvement and changing industry requirements," explained MacLean. "We have to take on the responsibility to serve them well. We just can't operationalize our partner network with an inflexible platform." For MacLean, this meant building a data foundation that would be flexible enough to work with various sources without imposing unnecessary complexity on other organizations.

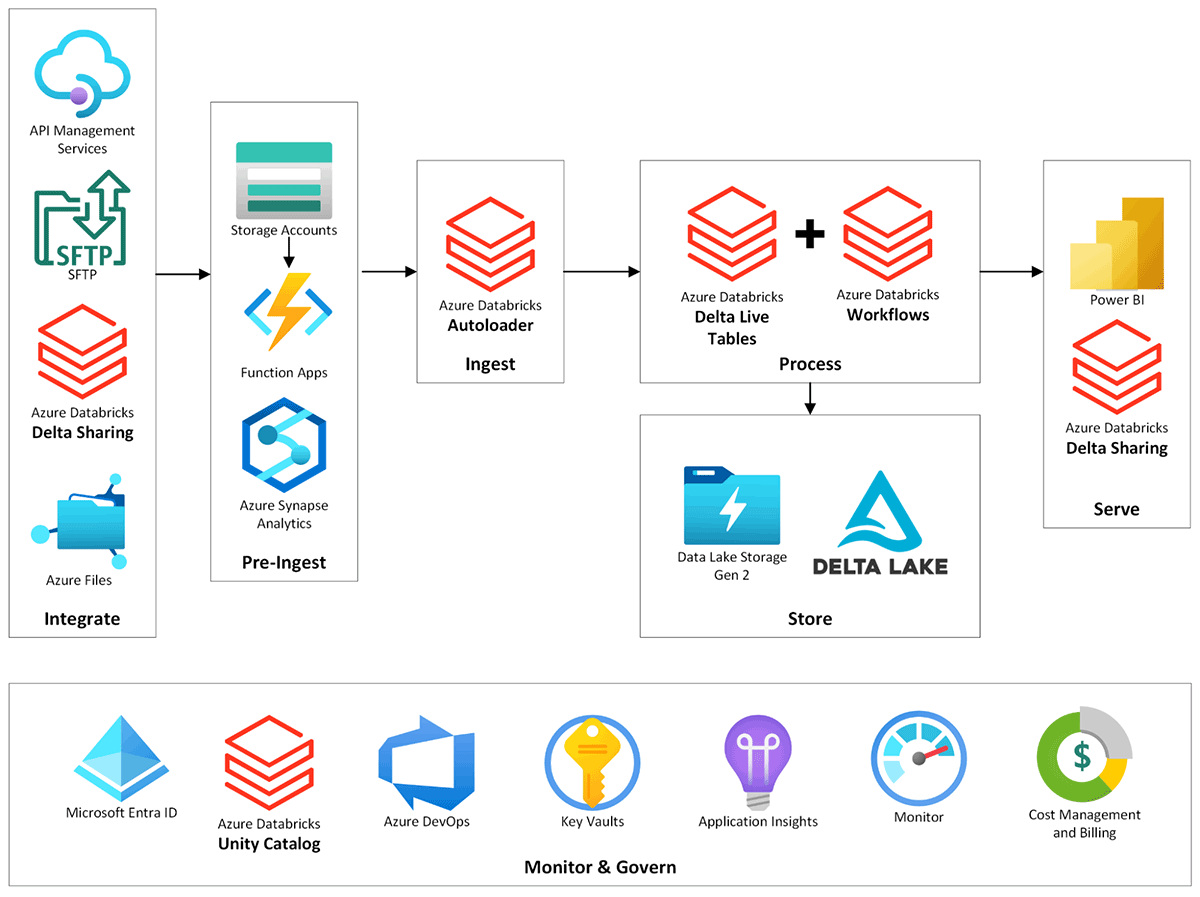

Embarking on its journey toward a more collaborative approach to community banking and banking-as-a-service (BaaS), Coastal chose Cavallo Technologies to help develop a modern data platform to support its stringent customer data sharing and compliance requirements. "In some ways, Coastal was asking for a paradox: enable easy collaboration yet meet the highest security standards for consumer financial data. It's critical to ensure the platform is performant and cost-effective for today's workloads while also adaptable enough to handle future use cases not yet imagined. In the end, the Databricks Data Intelligence Platform was the only platform we found that empowered us to do that," said Rob Cavallo, President at Cavallo Technologies. Despite the challenge of balancing accessibility with security, they found in Databricks a solution that was efficient, cost-effective, and flexible for both current and future needs.

Sharing data across platforms, clouds and regions with strong security and governance

The One team had been looking to deprecate their use of Google BigQuery as they needed a unified platform for engineering, analytics, and data science that supported multiple languages, support for transforming and inferring semi-structured data, native orchestration, and streaming.

The team was able to quickly share data and control access at a granular level with Delta Sharing. Moving to Databricks as its new platform, Coastal was able to start receiving relevant data tables in a secure workspace with One's data team in less than ten minutes - something they weren't able to accomplish after weeks of struggling with Google BigQuery.

With Coastal processing transactions for One, their business team requested summary reports to come on Saturdays. Previously this would have required Coastal to hire additional staff to cover on weekends since this was all done manually. But with Databricks, Coastal was able to automate report generation and provide reliable delivery to its partners. "This just wasn't possible with our prior tooling, plain and simple," said MacLean.

As part of their unique relationship and integrations with Walmart, One is available to Walmart's 1.6 million associates and 150M+ weekly shoppers in addition to being available to consumers everywhere. Given the reach of One, the scale of data for even transactional elements they look to share with Coastal on a daily basis soon hits a limit in terms of how to move that amount of information easily, safely and securely while meeting financial processing time windows.

Together, with partners like One, Coastal has seen significant customer growth that shows no signs of slowing down. Since customers always expect and demand real-time access to their money, Coastal's infrastructure must support real-time transactions today and in the future, and at a scale beyond which most banks operate. "If you're moving a dollar or a million dollars in a transaction, it's irrelevant to the systems required to support those transactions," explained Cavallo.

Transforming infrastructure that delivers long-term customer value

- Consolidated ETL operations by replacing SAS, Azure Data Factory, and manual Python scripts with a unified system, leading to significant cost savings and the retirement of outdated infrastructure.

- Developed an automated financial transaction system that meets regulatory requirements, cutting processing costs by 80%, enhancing accuracy, and simplifying audits.

- Overhauled a crucial scoring engine to deliver results in 30 minutes instead of 48 hours, enabling it to operate autonomously with detailed output for business decision-making.

Learning important lessons through the transformation journey

Along the way, a thorough evaluation of competitor products and niche data platforms targeted at financial services was consistently performed. This openness to the idea that there may be a better solution, and validating that none of those other technologies were fit for purpose reinforces the choice of Databricks as the best possible solution. Overall, the conclusion was that simplicity and unification always win.

Another learning was success requires more than just domain expertise. "Effective teamwork hinges on a blend of technical experts, business specialists, and individuals adept at managing intricate discussions. In other words, everyone must check their egos at the door and work together to reach the common goal. This is critical," says MacLean. "Collaboration and humility are essential."

Coastal believes in automating routine tasks to liberate engineers for higher-value work. Databricks simplifies workflows, allowing engineers to focus on understanding customer challenges and devising solutions, thus adding more value to the company. This approach enables engineers to take on wider roles without the need for extra teams to manage cross-functional projects, giving Coastal a competitive edge through full ownership of the process from start to finish.

The biggest lesson for Coastal in its efforts was that in an industry of giants, small teams can win too. When operational workflows are streamlined and technology unified, the constraints that typically hold back teams are eliminated — putting these teams of highly skilled, innately motivated collaborators in a position to help the business make transformative decisions.

Continuing to experience the benefits of a unified platform

Databricks Data Intelligence Platform is the only platform that allows Coastal to harness the complexity of data engineering and infrastructure management, instead of being buried under it. This way, its team can continue to meet and exceed expectations for the bank. "We never have to go and find out if the platform can do it," explains Cavallo. Instead of wasting valuable time figuring out where each tool should fit, Coastal can focus on executing faster, cheaper, and more efficiently. For instance, without Delta Live Tables and Unity Catalog, many workarounds — and custom solutions requiring maintenance and governance teams — would have been required. Not to mention, Coastal engineers' ability to leverage the tooling to alert, quarantine, and respond to various production events. "From a dead sleep to automated on-call callouts on the off-chance they happen, time to resolution has been as fast as eighteen minutes," explains MacLean.

Additionally, the support from the Databricks team has been unparalleled, making the Coastal team feel as if they are its most important customer. The team loves working with this toolset, and they get full credit for what they've been able to do and deliver with these tools in hand. With close engagement with the Databricks team, Coastal was able to realize a 25% cost reduction in a single afternoon with minimal effort. In another case, they had a request from the bank's leadership which previously would have taken several days or even weeks to respond to. Through the efforts of a small team of 10 data engineers and using the Databricks Data Intelligence Platform, using data sharing and governance features such as data lineage in Unity Catalog, they provided the answer from across their dataset within hours. This pairing of Databricks' expertise and the small, high-agency team at Coastal is how a small community bank can not only survive but also thrive.

"We've delivered two years' worth of work in nine months with Databricks as our underlying platform. Our teams can now access a single source of truth and rapidly process high volumes of transactions— giving us confidence that we can drive our growth as a community bank and a leading banking-as-a-service provider."

Barb MacLean will be sharing more of Coastal Community Bank's transformation story at this year's Databricks Financial Services Forum in New York on March 6. You can also watch her keynote from the on-demand replay in April.

- Read A New Approach to Data Sharing, Second Edition eBook

- Read Accelerate Industry Innovation with Data Sharing eBook

- Read O'Reilly technical guide, Data Sharing and Collaboration with Delta Sharing (early release)

Never miss a Databricks post

What's next?

Data Science and ML

October 1, 2024/10 min read

ICE/NYSE: Unlocking Financial Insights with a Custom Text-to-SQL Application

Product

November 27, 2024/6 min read