How Lakehouse powers LLM for Customer Service Analytics in Insurance

Download Insurance LLM Solution Accelerator

Introduction

The current economic and social climate has redefined customer expectations and preferences. Society has been forced to become more digital, and this extends to customer service in insurance companies.

However, there is a significant challenge in approaching this issue with a data-driven mindset. Historically, structured data has been the main ingredient that allows companies to analyze the past in order to understand and predict the future. By leveraging Natural Language Processing (NLP), companies can analyze different sources of unstructured data generated by customers, such as audio from phone calls and free text from chat messages.

Natural Language Processing (NLP) refers to a set of technologies that enable computers to understand, interpret, and generate human language. In the insurance industry, NLP can be used to automate tasks that require understanding and processing large amounts of written or spoken language, particularly in customer service, claims processing, and underwriting.

Today, customers have different expectations regarding product customization and value. They prefer insurance integrated into their daily lives rather than something they renew once a year. A seamless customer experience is now expected, with 58% of consumers stating that their customer service expectations are higher than they were a year ago, according to TalkDesk. Another report from Bain & Company reveals that globally, 59% of 28,765 consumers in 14 countries want life insurers to reward them for healthy living.

From the perspective of insurance providers, keeping up with customer demands can be challenging. Forrester estimates that 53% of support teams have seen an increase in support queries since the pandemic started. Providing a digital, self-service experience becomes paramount in order to reduce pressure on insurance contact centers.

Insurance companies have been using chatbots and IVRs for years to respond to customer queries about common insurance topics such as checking the status of a claim, reporting claims, and understanding insurance coverage. However, the challenge is to ensure that IVRs provide an engaging user experience without overwhelming customer service agents with too much complexity and overhead. According to Oliver Wyman, most of the pain points resulting in a less-than-ideal customer experience are as follows:

- Screening: Customer chatbots often struggle to interpret more complex customer requests. These chatbots may have limited comprehension capabilities, making it difficult for them to understand the reason behind a customer's call. Large Language Models (LLMs) have shown improved capabilities compared to traditional Natural Language Processing (NLP) in this area.

- Routing: There is limited routing of customers, as the chatbot may not fully understand the nature of the customer request, resulting in the customer being routed to a person, and most likely waiting on hold again.

- Resolution: Customer service agents lack essential tools to resolve inquiries quickly. Chatbots may not accurately summarize customer requests, retrieve insurance documents to verify coverage, or provide a list of relevant solutions for the agent. As a result, agents may need to ask the customer to repeat the reason for calling, causing further delays as they retrieve the customer's policy and relevant details, not to mention degradation of the customer service experience.

To improve the customer experience, insurance companies should consider leveraging more advanced technologies, such as LLMs, to enhance chatbot comprehension and routing capabilities. Providing agents with comprehensive tools that allow quick access to customer information and relevant resources can also help streamline the resolution process.

It can be daunting for insurers to define the best strategy for providing better customer experience and care, while dealing with the challenges of scaling and training their customer service workforce. How to properly balance the two sides of this coin? And most importantly, where to start?

Potential Outcomes of Applying NLP to Customer Service

Investing in a holistic digital transformation strategy can help insurance companies seamlessly scale their operations while shifting budgets and human resources from operational processes to actual product and value creation. In the context of customer service, one of the key considerations when formulating such a strategy is call deflection. By understanding common customer pain points and empowering them with self-service channels, insurance companies can scale more easily while providing a faster and more relevant customer experience.

To apply digital transformation to customer service in the insurance domain, we need to understand why customers are getting in touch. For instance, we might want to know:

- What are the top 10 reasons for customer calls?

- How many customers are calling for assistance with auto insurance versus other types of products, such as life insurance or health insurance?

- How are these distributions changing month-over-month or year-over-year?

These insights will allow us to formulate a proper strategy for customer service, as well as other areas such as marketing and usability. Additionally, we can analyze which products or topics are potentially problematic, such as when there are too many contact re-occurrences from the same customer. Finally, we need to investigate whether our customer service team is well-prepared to serve our customers.

Doing this kind of analysis requires organizations to convert raw text into well-understood statements (classified text) and relies on structured data. In the context of natural language processing, transformer models –such as BERT, GPT, and ChatGPT– have made it possible for companies to extract valuable, structured insights from this type of data at an unprecedented scale. These models allow for easy classification of customer utterances based on specific customer intents, as well as gauging customer sentiment.

Implementation Challenges & Motivation

Once a company understands its customers, it can move to the right side of the Data and AI Maturity Curve. Natural Language Processing (NLP) and Transformer models can assist in automating customer experiences, such as using chatbots for engagement, and personalization, such as predicting customer intents and their next interactions based on prior history. Despite the potential of NLP and Transformers, the current adoption landscape in most enterprises shows that there is a significant untapped opportunity. According to McKinsey, as of the end of 2022, only 11% of enterprises have or plan to include Transformer models as part of their AI products.

Solution

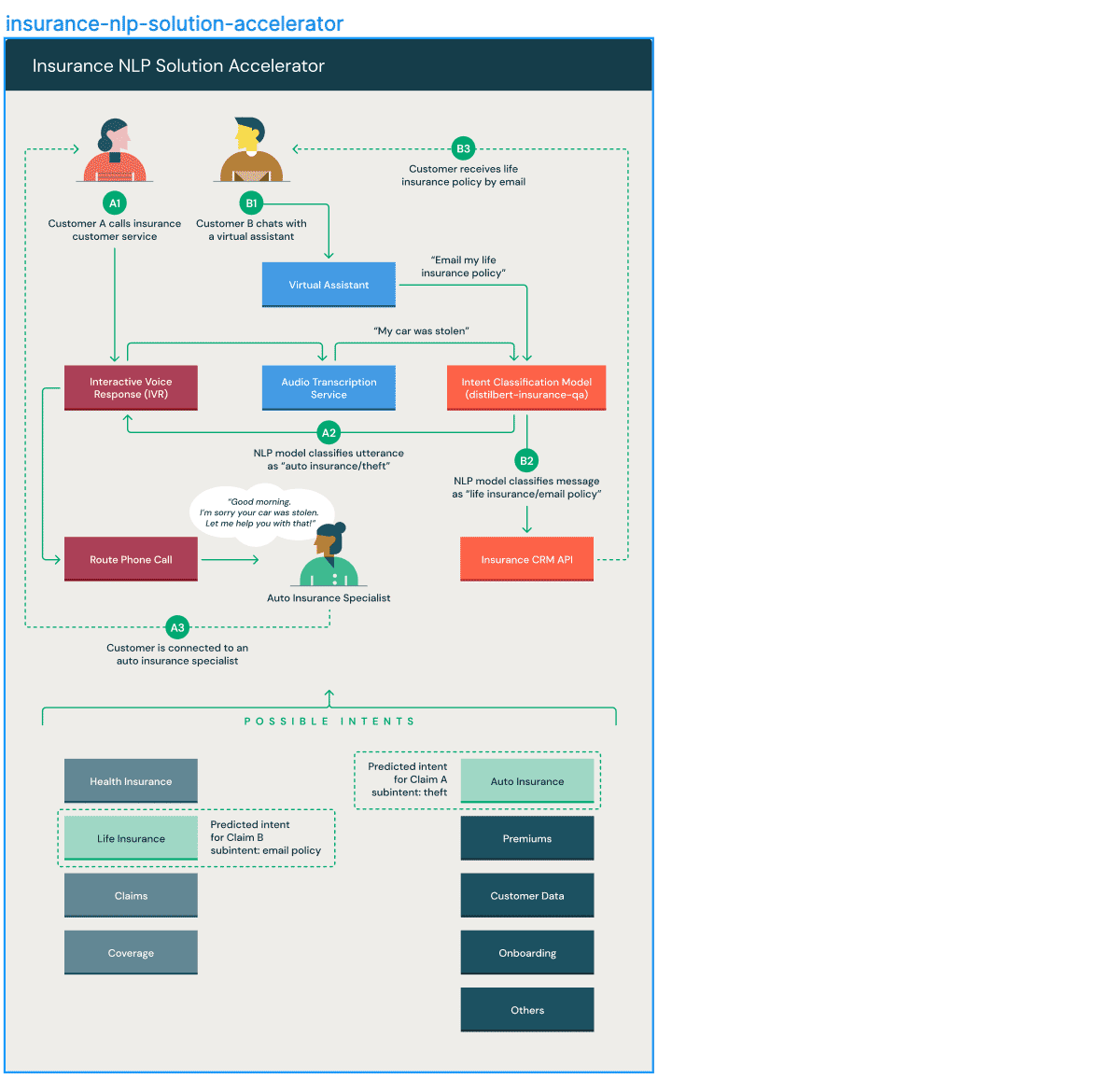

We are pleased to announce the launch of a new Solution Accelerator specially designed to set the technical best practices and reusable capabilities around the creation and maintenance of NLP and Transformers models for insurance call center analytics. The solution accelerator is a set of artifacts (data, notebooks, code, visualizations) that gives companies a head start on developing and deploying a machine learning solution. In the following sections, we will look at the different components of this solution accelerator.

The purpose of this solution accelerator is twofold:

- Detecting customer intents at scale based on textual data from an Interactive Voice Response (IVR) stream or initial interactions between a customer and a service agent.

- Classifying opening sentences from customers to a customer service chatbot in real-time.

Conclusion

In conclusion, the capabilities of NLP, Transformers, and Large Language Models (LLMs) will continue to evolve. However, it's important to note that no insurance company possesses perfect data. Recent changes in the macroeconomic environment, such as inflation, supply chain disruptions, evolving loss trends, and the impact of climate change on catastrophes, along with workforce changes and updates in underwriting rules and coverage eligibility criteria, have drastically altered insurers' business mix. As a result, historical data may not effectively generalize to future scenarios.

Insurers have two options: they can either acquire external or third-party data to supplement their structured data derived from operational systems (such as policies, exposures, premiums, coverage, and claims), or they can enhance their internal structured data with internal unstructured data, including voice calls/audio, images, text, and videos.

Summary

Our goal with this solution accelerator is to demonstrate how easy it can be to achieve digitization capabilities by utilizing customer unstructured data and leveraging NLP, Transformers, and a Lakehouse platform.

To get started on developing and deploying a machine learning solution for detecting customer intent based on pieces of text from an Interactive Voice Response (IVR) stream or from a virtual agent, download the Insurance NLP Solution Accelerator.

Download the Insurance NLP Solution Accelerator

Never miss a Databricks post

What's next?

Product

November 27, 2024/6 min read

How automated workflows are revolutionizing the manufacturing industry

Healthcare & Life Sciences

December 19, 2024/5 min read