Optimizing Promotional Offers using Causal Machine Learning

Published: August 28, 2023

by Luis Moros, Corey Abshire and Ryuta Yoshimatsu

Many companies offer their clients promotional offers to close deals, renew subscriptions, or purchase services. These incentives carry costs for the seller in terms of revenue or service that's being given to the customer in exchange for the purchase. But when applied appropriately, they can help ensure the transaction is committed and can even expand the size of the purchase. But not all accounts receiving an incentive offer will react in the same way. Applied inappropriately, a promotional offer may have no impact on the size of velocity of a deal and/or may unnecessarily erode margins. It's critical for organizations proposing incentives to customers to both anticipate the effect of the offer on the probability deal completion and understand the impact it will have on the deal's net profitability.

Optimizing Promotional Offers Can Lead to Better Outcomes

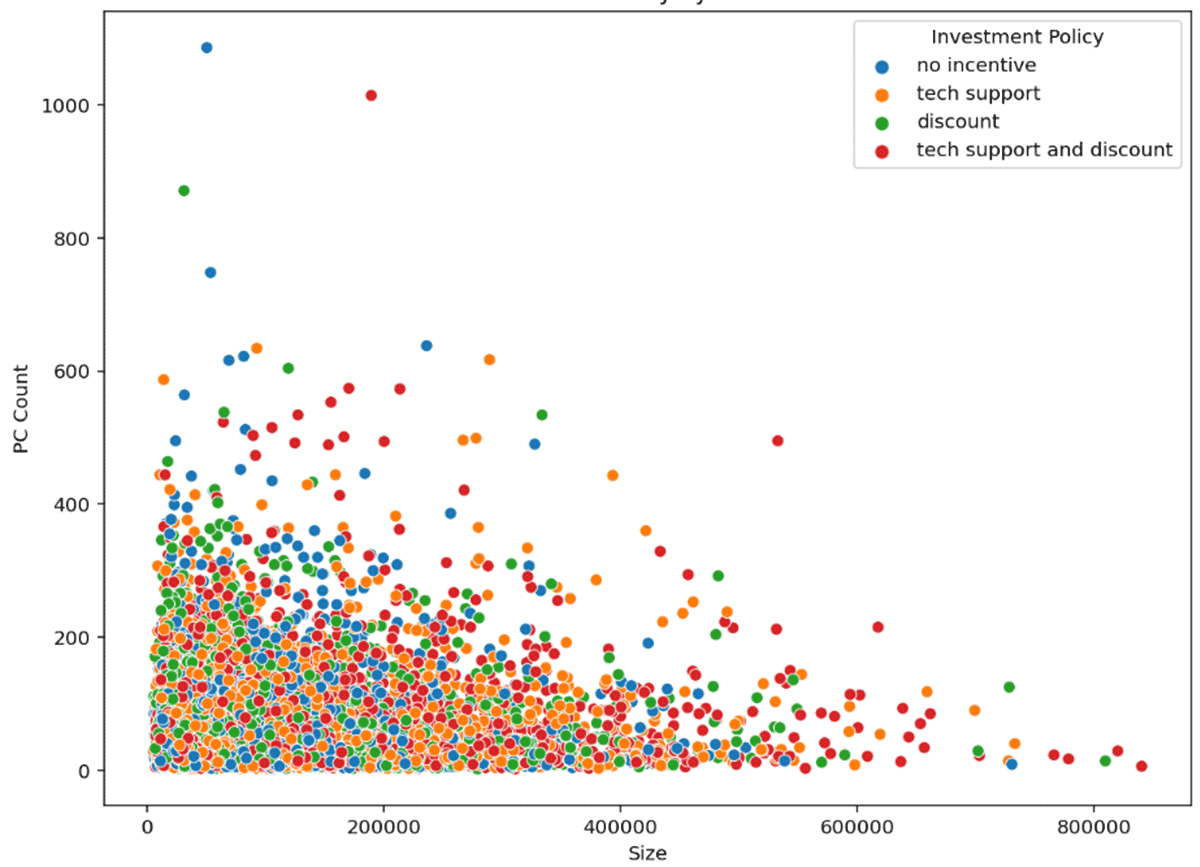

Consider the fictitious case of a software company that has been providing several types of promotional offers for a year without explicit controls over how sales teams apply them to different proposals. When deals are presented to different customer accounts with differing desktop counts and levels of revenue without such controls, we might see random sprinkling of offer types across accounts of differing sizes (Figure 1). .

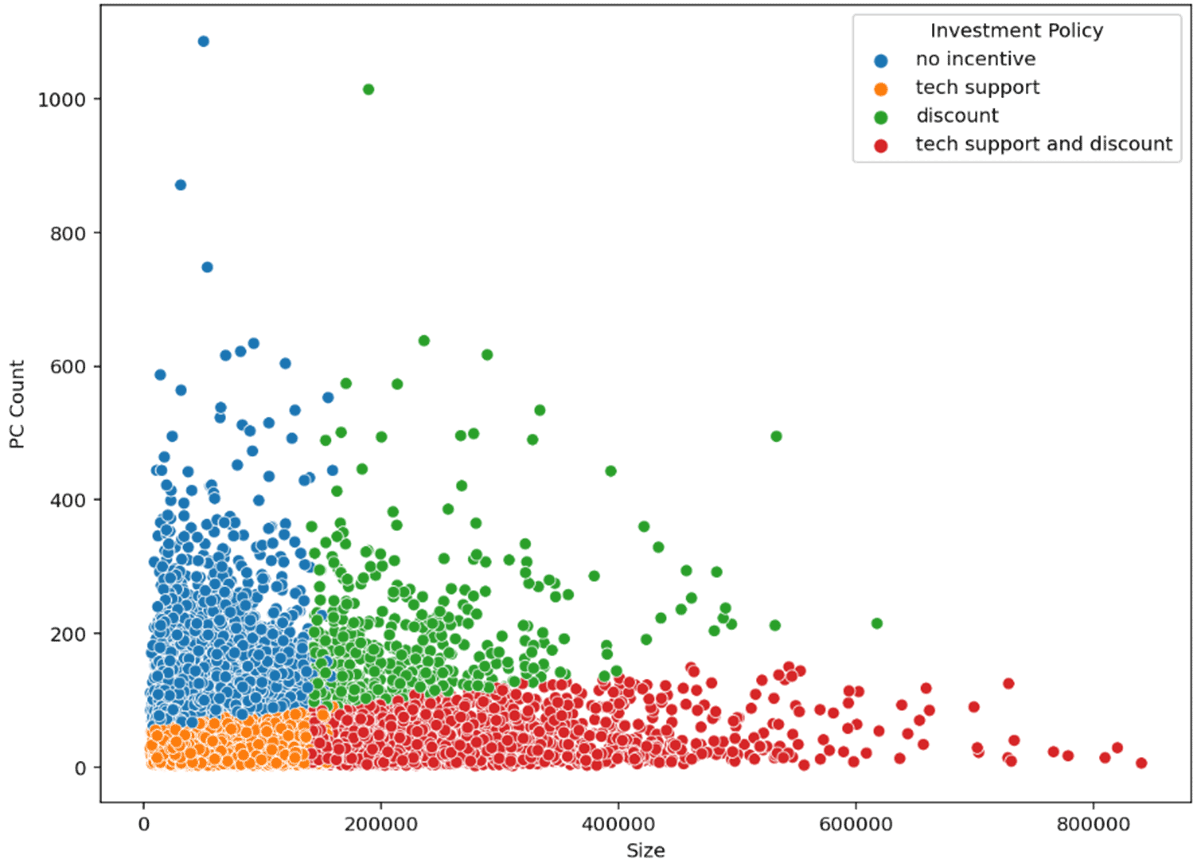

When we explore how these different offers affect the probability of deal closure and margins for those deals, we can identify distinct combinations of attributes that tend to lead to optimum results for the software company (Figure 2).

The results of this work are not just a more structured, programmatic way of applying promotional offers to deals, but instead have real implications for account margins. Consider this comparison of different strategies on the average margin for each account (Table 1).

| Policy Description | Average Marginal Profit per Account |

|---|---|

| Giving no promotional offer | $0.00 |

| No policy (No sales controls) | $312.85 |

| Always giving only 'tech support' | $1,816.19 |

| Always giving only 'discount' | -$1,684.62 |

| Always giving 'tech support' and 'discount' | $131.56 |

| Giving optimized promotional offer | $4,961.88 |

Table 1. The impact of different promotional offer policies on average account margins

The table shows a marginal profit increase greater than $4,900 when using the optimized approach as opposed to letting the sales team decide when to give which promotional offer. The table also indicates that recommending specific promotional offers in different account scenarios is better than any other naive approach i.e. always given only one promotional offer, always given both promotional offers , and never giving a promotional offer

Causal Machine Learning Can Elicit the Drivers Behind These Outcomes

But how do we know which offers to recommend in different scenarios in order to drive optimized outcomes? Using new capabilities in the field of causal machine learning (Causal ML), we can combine an analysis of probabilistic relationships in the data with domain knowledge to deliver models capable of predicting which options in a given scenario are likely to lead to a desired outcome. It's some heady stuff to be sure, but it's an area of active research that's allowing organizations to tackle tough problems that previously were beyond the reach of classic approaches.

To provide an introduction to Causal ML, we've collaborated with the team behind the PyWhy ecosystem of open source tools for causal machine learning to demonstrate how these techniques can be applied in a sales incentive optimization scenario. You can download the technical notebooks loaded with explanatory detail here to begin your journey in this space. We believe that once you've been introduced to how Causal ML approaches various problems, you'll begin to see additional opportunities for its application in a variety of scenarios relative to your business.

Databricks Provides a Platform for Causal Machine Learning

After you've become acquainted with Causal ML and how PyWhy provides you the ability to implement solutions in this space, the natural next question is, why Databricks? Databricks provides a unified analytics platform for all data and all modes of analytics, including causal machine learning.

For many customers that have standardized on the Databricks Lakehouse Platform, implementing Causal ML solutions on Databricks is a natural evolution of their existing predictive workflows. Data scientists and data engineers can collaborate on one platform, taking advantage of the data processing horsepower provided by Databricks to prepare the inputs for this work and leveraging native and third-party UIs for the analysis of outputs without the need for data replication between environments.

As Databricks customers success with the techniques, the model deployment and hosting capabilities available with Databricks provides multiple paths for the integration of these advanced predictive capabilities with various operational workflows. In short, Databricks removes the impediments to organizations pursuing their objectives with their data, allowing them to focus on realizing the potential of the insights found within them.

We would like to give a special thanks to the steering committee behind the PyWhy libraries for their support and encouragement with this work.

Never miss a Databricks post

What's next?

Retail & Consumer Goods

September 20, 2023/11 min read

How Edmunds builds a blueprint for generative AI

Retail & Consumer Goods

September 9, 2024/6 min read